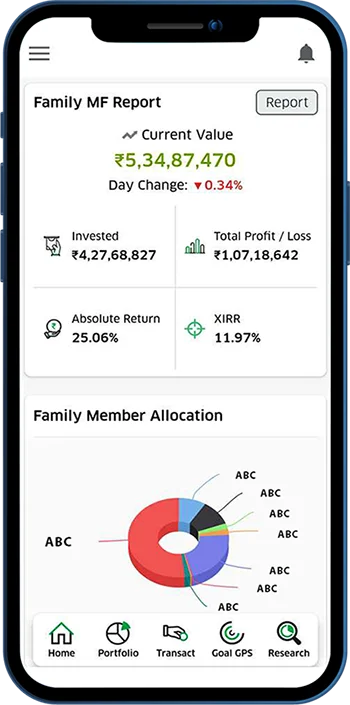

You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

About Us

At Ben Finex, we empower you to navigate the complexities of equity markets, mutual funds, and alternative investments with confidence. Backed by decades of experience, our approach combines market insight with a commitment to helping you make informed investment choices that align with your financial goals.

Ben Finex Advantage

- Research-Backed Approach: Leveraging market research and analytics to support your decisions.

- Strategic Portfolio Reviews: Regular assessments to keep your investments on track.

- Long-Term Value Creation: Driving sustainable growth through disciplined, informed practices.

Why Choose Ben Finex?

- 30+ Years of Market Expertise: In-depth knowledge of multiple market cycles, helping you adapt to changing market dynamics.

- Holistic Investment Access: Equities, mutual funds, and alternative investments tailored to diverse investment preferences.

- Data-Driven Insights: Leveraging research and analytics to identify market opportunities and risks.

- Transparent Communication: Consistent updates to keep you informed and confident in your investment decisions.

- Dedicated Support: Seamless assistance for trading and investment execution.

Our Team

Benny MS

MD & CEO

Beena Benny

Director

Maria Ben

ConsultantAssets Under Management

Happy Customers

Man Years of Experience

Hard Workers

Explore our Services

Invest in Mutual Funds

Invest online securely and conveniently with seamless digital transactions, enabling you to grow your wealth anytime, anywhere.

Invest in Stocks

To seamlessly open your demat account and transact in stocks with Aditya Birla Capital

Online KYC

Complete your KYC online securely and hassle-free from anywhere, ensuring quick verification for seamless financial transactions.

Portfolio Analysis

Get a comprehensive portfolio analysis to assess performance, manage risk, and optimize your investments for better returns

Our Partners

Testimonials

Discover how we've helped our clients in their investing journey

I have known Mr. Benny M.S. since 2020, and he has been guiding my investments. His extensive experience and personalized...

Abu Junaij

One of the standout qualities of the team is their deep understanding of my financial goals and their ability to...

Arun Panol

I've been availing your services for many years for my investments in stocks and securities, and I'm truly impressed with...

Aloshious Antony

Explore Our Tools

Mobile App Features

-

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.

Frequently Asked Questions

-

How do I start investing online?

To start investing online, complete your KYC, choose an investment option, fund your account, and start investing securely through our digital platform.

-

What is Online KYC, and why is it required?

Online KYC (Know Your Customer) is a digital verification process to authenticate your identity for financial transactions. It is mandatory as per regulations to ensure compliance and prevent fraud.

-

How can I complete my KYC online?

You can complete your KYC online by submitting your PAN, Aadhaar, and a live selfie through a secure platform. The process is quick and hassle-free.

-

What are the benefits of online investing?

Online investing provides convenience, real-time access, lower costs, and diversified investment opportunities with minimal paperwork.

-

What is Portfolio Analysis, and how does it help?

Portfolio Analysis evaluates your investments' performance, risk exposure, and asset allocation. It helps optimize returns and align investments with your financial goals.

-

How often should I review my investment portfolio?

It is advisable to review your portfolio at least quarterly or whenever there are major market changes or personal financial goals adjustments.

Contact

Abu Junaij

Arun Panol

Aloshious Antony